Zerodha Success Story: From a Modest Start to a Market Leader

In the fast-paced world of stock trading, few stories are as inspiring as the Zerodha Success Story. Founded in 2010 by Nithin Kamath and his brother Nikhil Kamath, Zerodha has revolutionized the Indian brokerage industry. Today, it stands as India’s largest stockbroker by the number of active clients. Let’s take a deeper look at how the Zerodha Success Story unfolded, overcoming challenges and setting new industry benchmarks.

The Humble Beginnings

To begin with, Nithin Kamath had been trading stocks since he was 17. However, he noticed that high brokerage charges were a major hurdle for small investors and traders like himself. Consequently, he envisioned a platform that offered low-cost trading with complete transparency. Thus, Zerodha — a combination of “Zero” and “Rodha” (meaning barrier in Sanskrit) — was born to eliminate these financial barriers.

Initially, the journey was anything but easy. With limited funds and no external investors, the Kamath brothers bootstrapped the company. Nevertheless, their sheer determination and customer-first approach soon started paying off.

The Disruptive Business Model

Unlike traditional brokers, Zerodha introduced a In the fast-paced world of stock trading, few stories are as inspiring as the success story of Zerodha. Founded in 2010 by Nithin Kamath and his brother Nikhil Kamath, Zerodha has revolutionized the Indian brokerage industry. Today, it stands as India’s largest stockbroker by the number of active clients. Let’s take a deeper look at how Zerodha climbed to the top, overcoming challenges and setting new industry benchmarks.

The Humble Beginnings

To begin with, Nithin Kamath had been trading stocks since he was 17. However, he noticed that high brokerage charges were a major hurdle for small investors and traders like himself. Consequently, he envisioned a platform that offered low-cost trading with complete transparency. Thus, Zerodha — a combination of “Zero” and “Rodha” (meaning barrier in Sanskrit) — was born to eliminate these financial barriers.

Initially, the journey was anything but easy. With limited funds and no external investors, the Kamath brothers bootstrapped the company. Nevertheless, their sheer determination and customer-first approach soon started paying off.

The Disruptive Business Model

Unlike traditional brokers, Zerodha introduced a discount brokerage model. Instead of charging a percentage of the trade value, they charged a flat fee — ₹20 or even zero for equity investments. As a result, thousands of retail investors found trading affordable for the first time, marking an important chapter in the Zerodha Success Story.

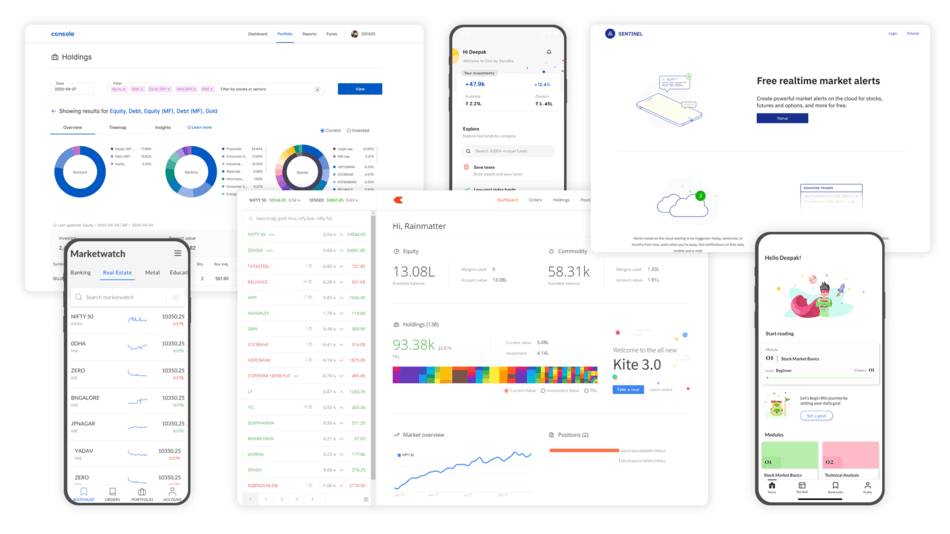

Moreover, Zerodha focused heavily on technology. They developed their own trading platform, Kite, which is user-friendly, fast, and mobile-optimized. In addition, educational initiatives like Varsity and community-building efforts like TradingQnA played a crucial role in the Zerodha Success Story, further distinguishing Zerodha from its competitors.

Overcoming Challenges

Of course, success did not come overnight. Initially, attracting customers without the backing of advertising budgets or big names was tough. However, through word-of-mouth marketing and a commitment to customer satisfaction, Zerodha gradually built trust.

Furthermore, the company faced stiff competition from well-established financial institutions. Yet, by staying true to their mission of transparency and affordability, Zerodha managed to carve out a loyal customer base.

Read More: Top 10 Audit Companies in India 2025

The Milestones

Over the years, Zerodha has achieved several impressive milestones. For instance:

- By 2019, it became India’s largest retail brokerage in terms of active clients.

- In 2020, during the COVID-19 lockdown, Zerodha saw a surge in new traders, further boosting its user base.

- By 2021, Zerodha was valued at over $2 billion, despite never raising external funding.

Notably, Zerodha’s success inspired a new wave of fintech startups in India, forever changing the landscape of stockbroking.

Key Reasons Behind Zerodha’s Success

To summarize, several key factors contributed to Zerodha’s phenomenal growth:

- Customer-centric approach: Prioritizing users’ needs over profits.

- Technological innovation: Constantly upgrading platforms for better user experience.

- Low-cost model: Making trading accessible to the masses.

- Transparency: Building trust by avoiding hidden charges.

- Educational initiatives: Empowering investors with knowledge.

Looking Ahead

Even today, Zerodha continues to innovate. Recently, it has expanded into areas like asset management and mutual fund distribution. Meanwhile, the Zerodha Success Story remains a testament to its founding principles — democratizing trading for every Indian.

Undoubtedly, the Zerodha success story proves that with vision, perseverance, and a customer-first attitude, it is possible to challenge giants and reshape an entire industry. Instead of charging a percentage of the trade value, they charged a flat fee — ₹20 or even zero for equity investments. As a result, thousands of retail investors found trading affordable for the first time.

Moreover, Zerodha focused heavily on technology. They developed their own trading platform, Kite, which is user-friendly, fast, and mobile-optimized. In addition, educational initiatives like Varsity and community-building efforts like TradingQnA further distinguished Zerodha from its competitors.

Overcoming Challenges

Of course, success did not come overnight. Initially, attracting customers without the backing of advertising budgets or big names was tough. However, through word-of-mouth marketing and a commitment to customer satisfaction, Zerodha gradually built trust.

Furthermore, the company faced stiff competition from well-established financial institutions. Yet, by staying true to their mission of transparency and affordability, Zerodha managed to carve out a loyal customer base.

Read More: The Ultimate Guide to Telegram’s Business Model

The Milestones

Over the years, Zerodha has achieved several impressive milestones. For instance:

- By 2019, it became India’s largest retail brokerage in terms of active clients.

- In 2020, during the COVID-19 lockdown, Zerodha saw a surge in new traders, further boosting its user base.

- By 2021, Zerodha was valued at over $2 billion, despite never raising external funding.

Notably, Zerodha’s success inspired a new wave of fintech startups in India, forever changing the landscape of stockbroking.

Key Reasons Behind Zerodha’s Success

To summarize, several key factors contributed to Zerodha’s phenomenal growth:

- Customer-centric approach: Prioritizing users’ needs over profits.

- Technological innovation: Constantly upgrading platforms for better user experience.

- Low-cost model: Making trading accessible to the masses.

- Transparency: Building trust by avoiding hidden charges.

- Educational initiatives: Empowering investors with knowledge.

Looking Ahead

Even today, Zerodha continues to innovate. Recently, it has expanded into areas like asset management and mutual fund distribution. Meanwhile, the company remains committed to its founding principles — democratizing trading for every Indian.

Undoubtedly, the Zerodha success story proves that with vision, perseverance, and a customer-first attitude, it is possible to challenge giants and reshape an entire industry.